Worksheet For Foreclosures And Repossessions

The foreclosure or repossession is treated as a sale from which you may realize gain or loss. Worksheet for foreclosures and repossessions.

Individual 1099 A 1099 C Foreclosure Repossession Quitclaim Shor

This is true even if you voluntarily return the property to the lender.

Worksheet for foreclosures and repossessions. If the property is foreclosed on or repossessed in lieu of abandonment gain or loss is figured as discussed later under foreclosures and repossessions. The fair market value of the transferred property for line 2 of the worksheet can be found on form 1099 c box 7. Table 1 1 worksheet for foreclosures repossessions short sales and abandonments.

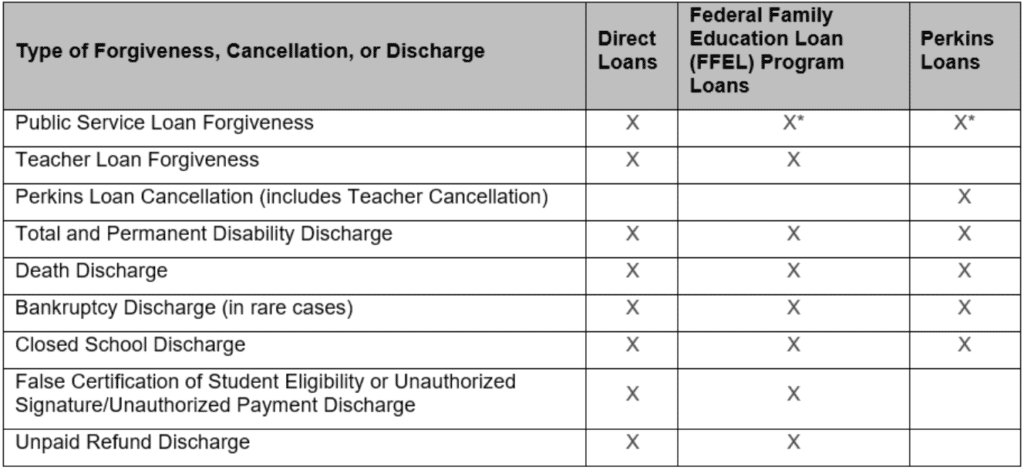

This publication explains the federal tax treatment of canceled debts foreclosures repossessions and abandonments. If this is personal property possibilities are a vacation home timeshare vehicle and some inherited property. Figuring your gain or loss.

Complete part 1 only if you were personally liable for the debt even if none of the debt was canceled. The abandonment loss is deducted in the tax year in which the loss is sustained. Of foreclosure is not an abandonment and is treated as the exchange of property to satisfy a worksheet for foreclosures and repossessions table 1 1.

Generally you abandon property when you voluntarily and permanently give up possession and use of property you own with the intention of ending your ownership but without passing it on to anyone else. The foreclosure or repossession is treated as a sale or exchange from which you may realize gain or loss. The sales proceeds will be the amount from line 6 of the worksheet for foreclosures and repossessions.

Generally if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount you are treated for income tax purposes as having income and may have to pay tax on this income. Worksheet for foreclosed homes. The cost or other basis will be the amount from line 7 of the worksheet for foreclosures and repossessions.

Answered by a verified tax professional. To determine cancellation of debt income use part 1 of the worksheet for foreclosures and repossessions from table 1 2 of publication 544 or table 1 1 of pub. Foreclosure or repossession is discussed later under foreclosures and repossessions.

On the worksheet for foreclosures and repossessions line 7 says enter the adjusted basis of the transferred property. Foreclosures and repossessions if you do not make payments you owe on a loan secured by property the lender may foreclose on the loan or repossess the property. To fill out this form online click here.

Complete this part 1 only if you were personally liable for the debt. Comments about tax map. Otherwise go to part 2.

Keep for your records part 1. Complete part 1 only if you were personally liable for the debt even if none of the debt was canceled. Otherwise go to.

Figure your ordinary income from the cancellation of debt upon foreclosure or repossession. Generally the cod income on line 3 of this worksheet will be.

What Is An Asset On An Insolvency Worksheet Chron Com

What Is An Asset On An Insolvency Worksheet Chron Com

7 Best Real Estate Videos Images Real Estate Video Distressed

7 Best Real Estate Videos Images Real Estate Video Distressed

Canceled Debts Foreclosures Repossessions And Abandonments Pdf

Canceled Debts Foreclosures Repossessions And Abandonments Pdf

Buying Texas Foreclosed Homes Requirements And Qualifications

Buying Texas Foreclosed Homes Requirements And Qualifications

Canceled Debts Foreclosures Repossessions And Abandonments

Canceled Debts Foreclosures Repossessions And Abandonments

Canceled Debts Foreclosures Repossessions And Abandonments

Canceled Debts Foreclosures Repossessions And Abandonments

Keegan Co Attorneys Llc Create Favorable Solutions For Your

Renters In A Foreclosure Consumer Business

Individual 1099 A 1099 C Foreclosure Repossession Quitclaim Shor

Publication 908 02 2019 Bankruptcy Tax Guide Internal Revenue

Publication 908 02 2019 Bankruptcy Tax Guide Internal Revenue

The Tax Consequences Of A Foreclosed Home

The Tax Consequences Of A Foreclosed Home

Foreclosure Repossession Quitclaim Short Sale 1099 C 1099 A

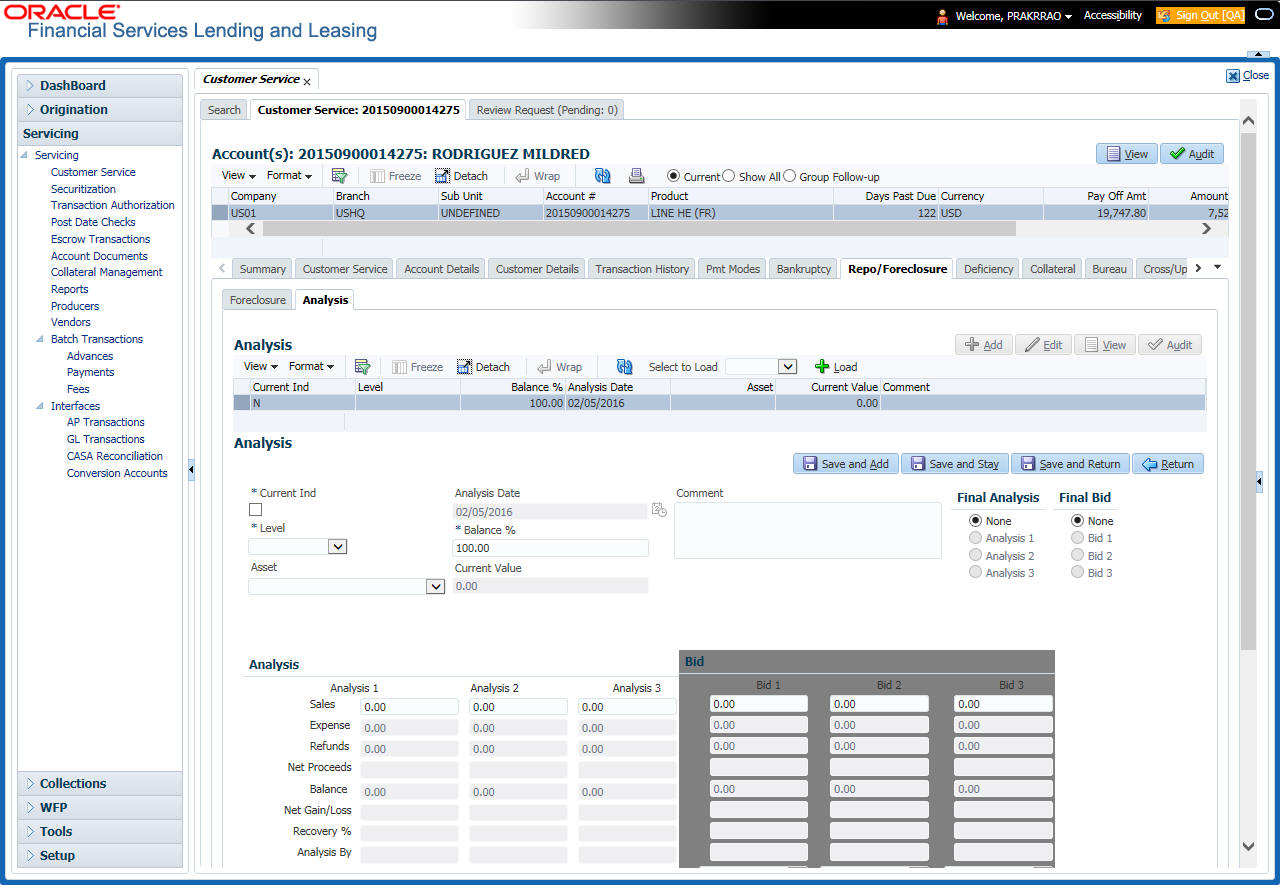

Foreclosure Information Listing Service Inc

Foreclosure Information Listing Service Inc

P4681 Publication 4681 Contents Canceled Debts Foreclosures

P4681 Publication 4681 Contents Canceled Debts Foreclosures

A Huge Tax Bill Is The Downside Of Student Loan Forgiveness

A Huge Tax Bill Is The Downside Of Student Loan Forgiveness

Canceled Debts Foreclosures Repossessions And Abandonments Pdf

Canceled Debts Foreclosures Repossessions And Abandonments Pdf

Foreclosed Homes In Michigan Bank Owned Homes In Michigan Foreclosures

Foreclosed Homes In Michigan Bank Owned Homes In Michigan Foreclosures

Foreclosure Irs Tax Implications What Taxes You May Owe

Foreclosure Irs Tax Implications What Taxes You May Owe

P4681 Publication 4681 Contents Canceled Debts Foreclosures

P4681 Publication 4681 Contents Canceled Debts Foreclosures

Belum ada Komentar untuk "Worksheet For Foreclosures And Repossessions"

Posting Komentar