Nebraska Inheritance Tax Worksheet

Nebraska inheritance tax worksheet 2018. 2290 form online new schedule d tax worksheet instructions thejquery with regard to 2290 form 2017.

State Inheritance And Estate Taxes Rates Economic Implications

State Inheritance And Estate Taxes Rates Economic Implications

Remote relatives are subject to an inheritance tax of 13.

Nebraska inheritance tax worksheet. Nebraska taxes property that is left by deceased nebraska residents or by nonresidents who owned real estate or other tangible property in the state. Nebraska inheritance tax is computed on the fair market value of annuities. The treasurers office will accept the court order or other written application to the county court or the inheritance tax worksheet that is completed with name of deceased date of death book and page number the tentative amount of inheritance tax due and the required consent of the county attorneys office.

Applications for abatement change form power of attorney etc. From our example you can add some things you may need to complete your spreadsheet. Estate executor spreadsheet for nebraska inheritance tax worksheet 311106 estate and gift tareturns.

Florida probate forms flssi. The image below is a simple example of nebraska inheritance tax worksheet that might inspire you in creating a spreadsheet or report for your business. Other transferees are subject to an inheritance tax of 18.

Irs form 1099 r worksheet. Nebraska inheritance tax worksheet form 500. Furthermore the extent to which such portion is subject to tax depends on the decedents relation to the beneficiary.

Estate executor spreadsheet for nebraska inheritance tax worksheet 311106 estate and gift tareturns. The nebraska inheritance tax rates are as follows. You can have this example by saving it to your computer tablet pc or smartphone.

Forms that apply to more than one tax program. Nebraska inheritance tax worksheet 2018. Unlike a typical estate tax nebraska inheritance tax is measured by the value of the portion of a decedents estate that will be received by a beneficiary.

Florida probate forms florida bar. 00101 nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests. Assuming such agreement is reached the tax is paid once the court approves the amount.

The inheritance tax rate depends on how closely the person who inherits the property was related to the deceased person. Tax worksheet must be completed essentially an inheritance tax return and an effort made to reach agreement with the county attorney as to the value of the taxable estate. Chapter 17 inheritance tax.

Nebraska inheritance tax worksheet 2017. Immediate relatives are subject to an inheritance tax of 1. Forms for bingo pickle card keno and raffle as well as the nebraska lottery retailer application forms.

Douglas County Nebraska Quit Claim Deed Form Mbm Legal

Douglas County Nebraska Quit Claim Deed Form Mbm Legal

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis

State By State Estate And Inheritance Tax Rates Everplans

State By State Estate And Inheritance Tax Rates Everplans

Estate Taxes State Death Taxes Continue To Die Out

:max_bytes(150000):strip_icc()/pittsburgh-skyline-at-blue-hour-from-river-bank-599106847-5783e2b15f9b5831b5cf476e.jpg) Nebraska Inheritance Tax Laws And How They Affect Estates

Nebraska Inheritance Tax Laws And How They Affect Estates

The 2018 Annual Estate Planning Probate Institute The Nuts And

Nebraska Inheritance Laws What You Should Know Smartasset

Nebraska Inheritance Laws What You Should Know Smartasset

Are Your Clients Subject To Massive Estate Taxes Without Knowing It

Are Your Clients Subject To Massive Estate Taxes Without Knowing It

The 2018 Annual Estate Planning Probate Institute The Nuts And

Inheritance Tax Worksheet Nebraska Inspirationa California Payroll

Inheritance Tax Worksheet Nebraska Inspirationa California Payroll

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And

Nebraska Land Inheritance Tax Archives Aggelies Online Eu

Esl Worksheets Locationbasedsummit Com

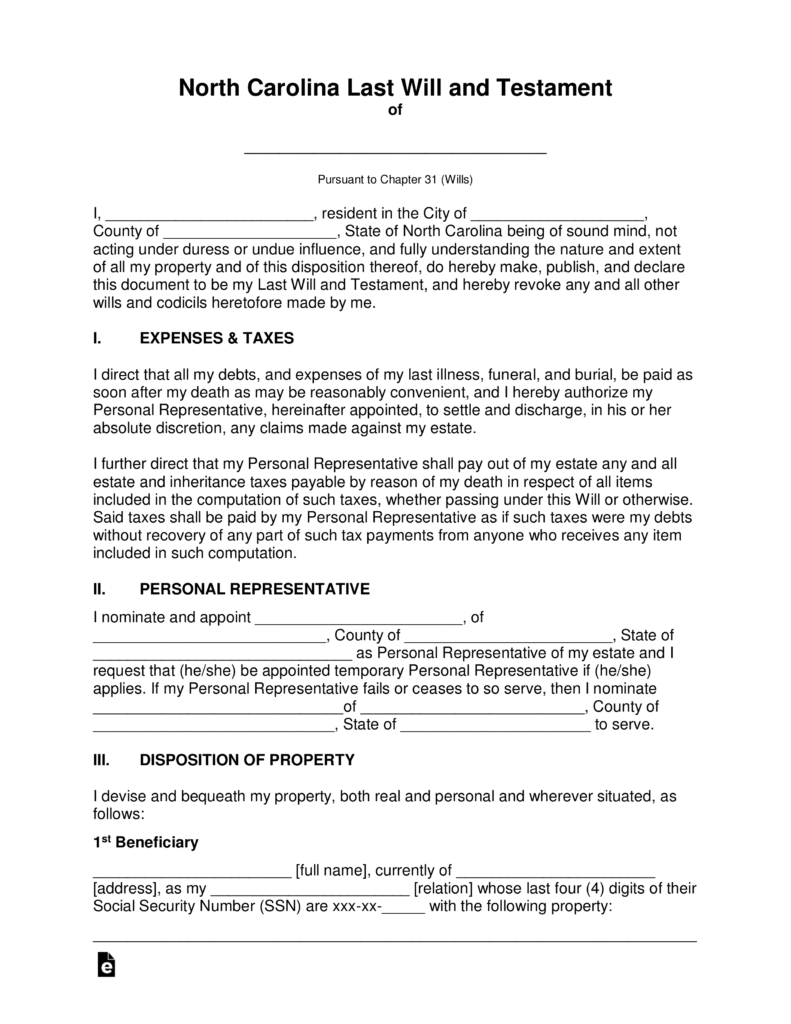

Free North Carolina Last Will And Testament Template Pdf Word

Free North Carolina Last Will And Testament Template Pdf Word

Severed From Any Invalid Portions Of The Ilarrant The Ruling Of

Supreme Court Worksheet Nebraska Inheritance Tax Worksheet Unique

Supreme Court Worksheet Nebraska Inheritance Tax Worksheet Unique

Nebraska Inheritance Laws What You Should Know Smartasset

Nebraska Inheritance Laws What You Should Know Smartasset

How To Calculate Inheritance Tax 12 Steps With Pictures

How To Calculate Inheritance Tax 12 Steps With Pictures

:max_bytes(150000):strip_icc()/GettyImages-159327786-5894cc775f9b5874ee1cc643.jpg) Nebraska Inheritance Tax Laws And How They Affect Estates

Nebraska Inheritance Tax Laws And How They Affect Estates

The Cost Of Wealth Transfer At Death Pdf

Back From The Dead State Estate Taxes After The Fiscal Cliff

Tax Worksheet Homeschooldressage Com

Learn About Nebraska Inheritance Tax Laws Free Printable Worksheets

Learn About Nebraska Inheritance Tax Laws Free Printable Worksheets

Do I Have To Pay A New York Inheritance Tax If My Parents Leave Me

Inheritance Tax Federal State Guide Updated Smartasset

Inheritance Tax Federal State Guide Updated Smartasset

How To Calculate Inheritance Tax 12 Steps With Pictures

How To Calculate Inheritance Tax 12 Steps With Pictures

Templates Nebraska Inheritance Tax Worksheet Aggelies Online Eu

Estate Inheritance Tax Threshold Rates Calculating How Much

Estate Inheritance Tax Threshold Rates Calculating How Much

Nebraska Estate Tax Everything You Need To Know Smartasset

Nebraska Estate Tax Everything You Need To Know Smartasset

Belum ada Komentar untuk "Nebraska Inheritance Tax Worksheet"

Posting Komentar