Schedule D Tax Worksheet 2014

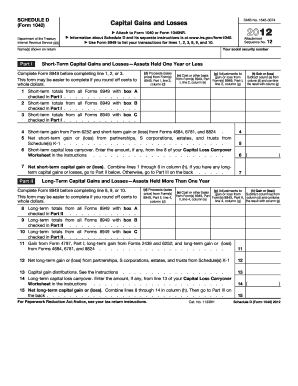

Click forms on the right side of the screen. A capital gain or loss occurs when you sell any property used for pleasure personal use or investment at a profit or a loss.

Form 1040 Schedule D Fillable Capital Gains And Losses

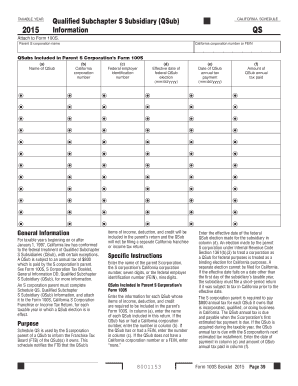

2014 schedule d tax worksheet form 1040 schedule d instructions page d 15 2013 schedule d tax worksheet form 1040 schedule d instructions page d 14 2012 schedule d tax worksheet form 1040 schedule d instructions page d 13.

Schedule d tax worksheet 2014. See form 461 and its in structions for more information on the. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero. To figure the overall gain or loss from transactions reported on form 8949.

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero. Schedule d tax worksheet. How to fill out a schedule d tax worksheet.

2014 instructions for schedule dcapital gains and losses these instructions explain how to complete schedule d form 1040. Otherwise complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040 line 44 or in the instructions for form 1040nr line 42 to figure your tax. 2012 schedule d tax worksheet form 1040 schedule d instructions page d 13.

Sign in to your taxact online return. Then go to line 17 below. Enter the amount from line 16 on schedule 1 form 1040 line 13 or form 1040nr line 14.

Any disallowed loss resulting from this limitation will be treated as a net operating loss nol that must be carried forward and deducted in a subse quent tax year. If line 16 is a. Otherwise complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040 line 44 or in the instructions for form 1040nr line 42 to figure your tax.

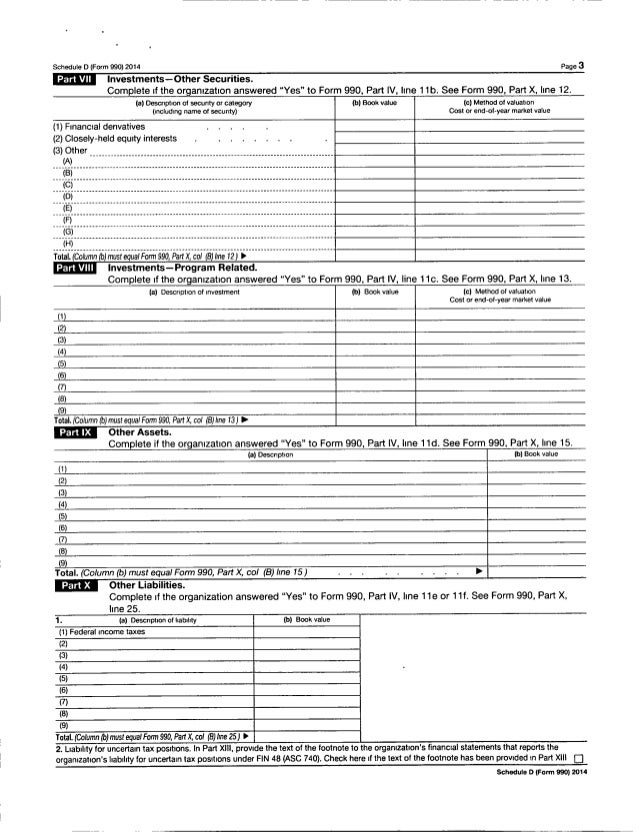

Schedule d designed to be submitted with form 1040 is a form used to report your capital gains and losses during the tax year. Instead use new form 461 to figure the amount to include as in come on schedule 1 form 1040 line 21. Click view complete forms list below forms.

2014 schedule d tax worksheet. 2013 schedule d tax worksheet form 1040 schedule d instructions page d 14. Schedule d form 1040 department of the treasury.

Complete form 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d. Tools for tax pros exoo. To view the tax calculation on the schedule d tax worksheet which will show the calculation of the tax which flows to form 1040 line 44 or form 1040nr line 42.

2014 schedule d tax worksheet form 1040 schedule d instructions page d 15.

Printable Schedule D Tax Worksheet 2016 Edit Fill Out Download

Printable Schedule D Tax Worksheet 2016 Edit Fill Out Download

Form 1040 Schedule D Capital Gains And Losses

Form 1040 Schedule D Capital Gains And Losses

Math Form 1041 Schedule D Capital Gains And Losses Tax2011irs With

2014 Irs Form 1040 Form Instructions Tax Table Inspirational

Capital Loss Carryover Worksheet 2016 To 2017

Capital Loss Carryover Worksheet 2016 To 2017

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker

Math Form 1041 Schedule D Capital Gains And Losses Tax2011irs With

Short Term Capital Loss Short Term Capital Loss Schedule D

Income Tax Forms Income Tax Forms Schedule D

Capital Gains Losses Including Sale Of Home Ppt Download

Capital Gains Losses Including Sale Of Home Ppt Download

2013 Capital Loss Carryover Worksheet Capital Loss Carryover

Printables Irs Schedule D Tax Worksheet Lemonlilyfestival

Irs Schedule D Worksheet Oaklandeffect

Tax Computation Work Tax Computation Worksheet 2014 Fabulous

Tax Computation Work Tax Computation Worksheet 2014 Fabulous

Capital Loss Carryover Worksheet 2013 Worksheet Activities On

Tax Computation Worksheet 2014 Winonarasheed Com

Schedule D Tax Worksheet Winonarasheed Com

Math Form 1041 Schedule D Capital Gains And Losses Tax2011irs With

Capital Loss Carryover Worksheet 2013 Worksheet Activities On

Irs Schedule D 1040 Form Pdffiller

Irs Schedule D 1040 Form Pdffiller

Capital Loss Carryover Worksheet 2013 Worksheet Activities On

Belum ada Komentar untuk "Schedule D Tax Worksheet 2014"

Posting Komentar