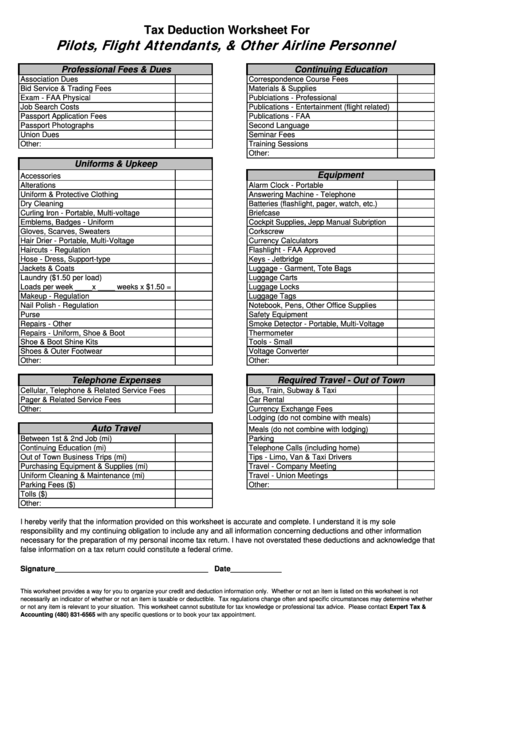

Airline Pilot Tax Deduction Worksheet

Download fill in and print tax deduction worksheet for pilots flight attendants other airline personnel pdf online here for free. We need both to prepare your tax returns.

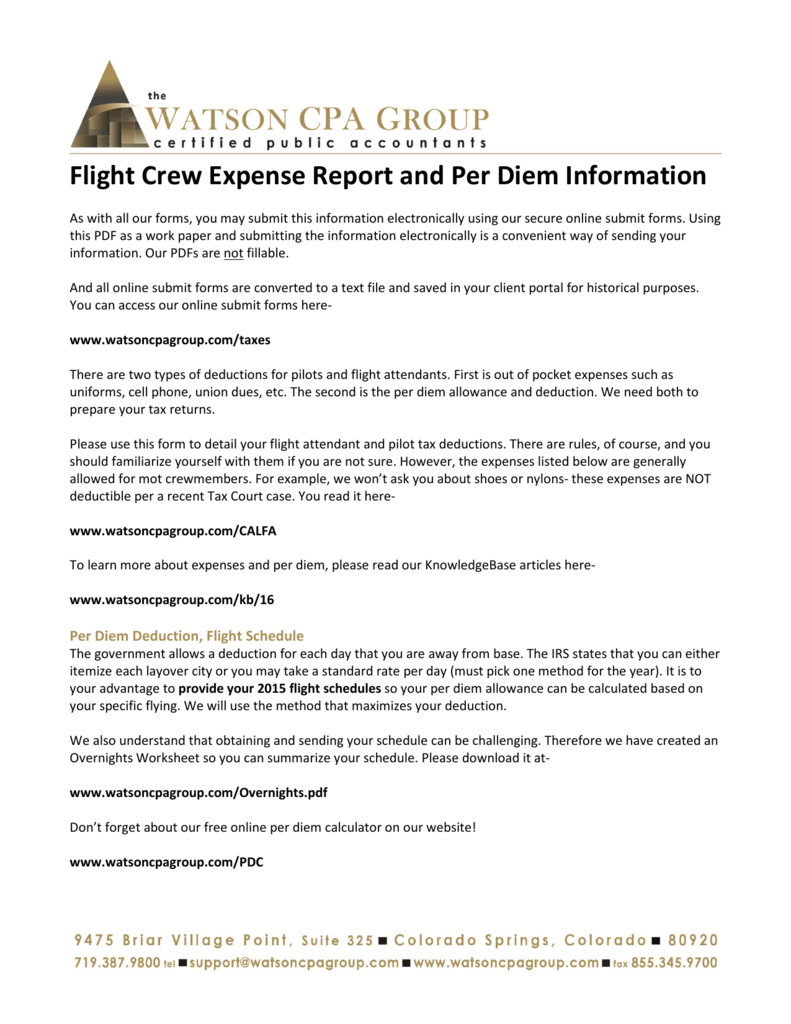

Flight Crew Expense Report And Per Diem Information

Flight Crew Expense Report And Per Diem Information

Glasses and contact lenses.

Airline pilot tax deduction worksheet. The expense must not be prohibited by the tax code. If the pilot or flight attendant cannot itemize then none of the employee business expenses or travel expenses including the per diem deduction can be written off the flight crewmember taxes. Do you pay taxes.

Please use this online submit form to detail your flight attendant and pilot tax deductions. This is in circumstances that they are required to work outdoors and are exposed to the risk. If so you might be missing out on a large tax deduction for airline crew members the per diem deduction.

However the van tips still need to be substantiated. Print name education and training to maintain and. In creating this worksheet four simple rules were followed as outlined by various irs publications and tax accounting standards.

Tax deduction worksheet for pilots flight attendants amp. A tip to a van driver is deductible. A pilot tips a van driver to take him from the airport to the hotel or vice versa.

Other airline employees may claim the cost of protective sunglasses. The second is the per diem allowance and deduction. Signature is required to process this tax deduction i understand that to deduct these expenses my employer would agree that these non reimbursed expenses were needed to perform.

First the expense must be ordinary which are expenses that are common and accepted in the airline or aviation industry such as uniforms and union dues. Deductible pilot or flight attendant expenses. There are two types of deductions for pilots and flight attendants.

Take a wristwatch for example. A wristwatch can certainly be argued to be ordinary and necessary for airline pilot tax or flight attendant tax purposes. Under the new tax law professional deductions are no longer allowed for your federal return if you live in al ar ca i ia mn ny or pa they still take them you ill need to complete this professional deduction organizer and submit it ith your organizer.

For airline pilots and flight attendants to use the itemized deductions the flight crewmember must be able to exceed the standard deduction amount that is published by the irs for each given year. Are you an airline pilot or flight attendant. Pilots and flight engineers can claim a deduction for the cost of anti glare glasses used to combat the harsh working conditions inside a cockpit.

This is a travel expense. Flight crew taxes made simple. Sometimes an employee business expense can pass all three of the tests above yet still not be deductible.

Airline pilot worksheet name. First is out of pocket expenses such as uniforms cell phone union dues etc. Also because it is a travel expense that is less than 75 a receipt is not required.

Other airline personnel is often used in tax worksheet template tax forms and financial.

49 Surprising Small Business Tax Write Offs You Might Be Able To Take

49 Surprising Small Business Tax Write Offs You Might Be Able To Take

Dcma Aviation Program Team Reference Book

The State Of State And Local Tax Policy Key Elements Of The U S

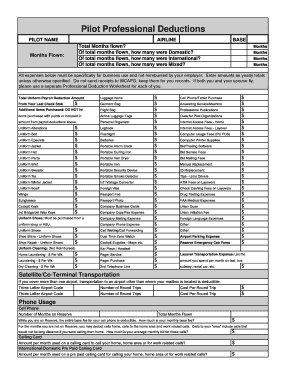

Pilot Professional Deductions Pilot Name Airline Total Months Flown

Pilot Professional Deductions Pilot Name Airline Total Months Flown

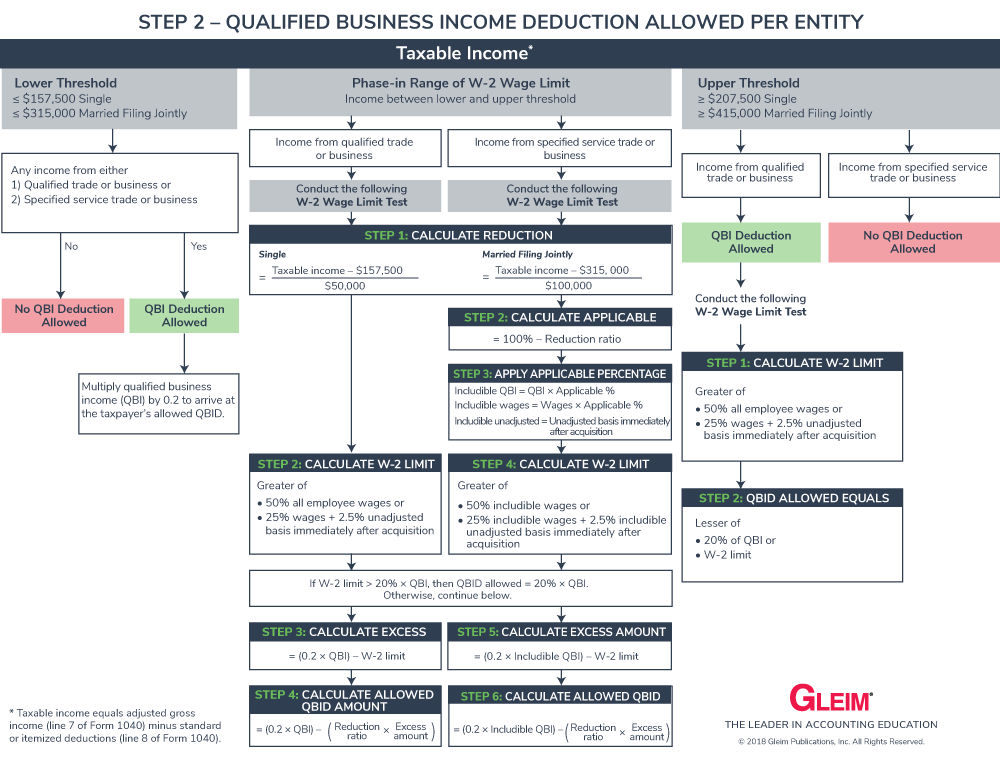

Section 199a Qualified Business Income Deduction Qbid Gleim

Section 199a Qualified Business Income Deduction Qbid Gleim

Ashland Or Cpa Full Service Tax And Business Consulting Nagel

Ashland Or Cpa Full Service Tax And Business Consulting Nagel

27 Elegant Truck Driver Expenses Worksheet Incharlottesville Com

Acc 455 Effective Communication Snaptutorial Com

Acc 455 Effective Communication Snaptutorial Com

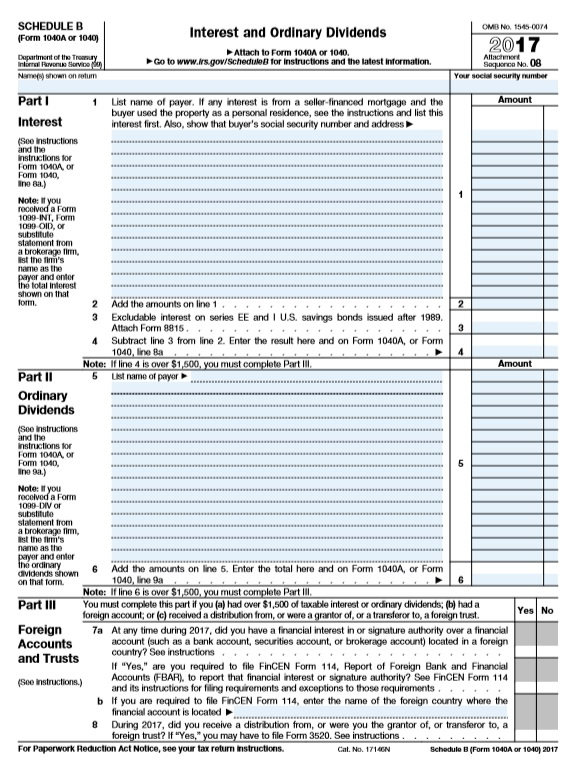

Solved How To Fill Out Schedule B Form 1040 And Qualifie

Solved How To Fill Out Schedule B Form 1040 And Qualifie

Section 199a Qualified Business Income Deduction Qbid Gleim

Section 199a Qualified Business Income Deduction Qbid Gleim

Flight Crew Expense Report And Per Diem Information

Crash Course In Tax Deductions For Realtors Advanced Commission

Crash Course In Tax Deductions For Realtors Advanced Commission

Your Money Checklist Money Under 30

Your Money Checklist Money Under 30

Flight Crewmembers Receipts And Recordkeeping Flight Crew Taxes

Flight Crewmembers Receipts And Recordkeeping Flight Crew Taxes

Cost Of Flying Calculator Spreadsheet Flying

Cost Of Flying Calculator Spreadsheet Flying

Testimonials F C Tax Accounting Inc

Per Diem Deduction Per Diem Calculation Per Diem Allowance

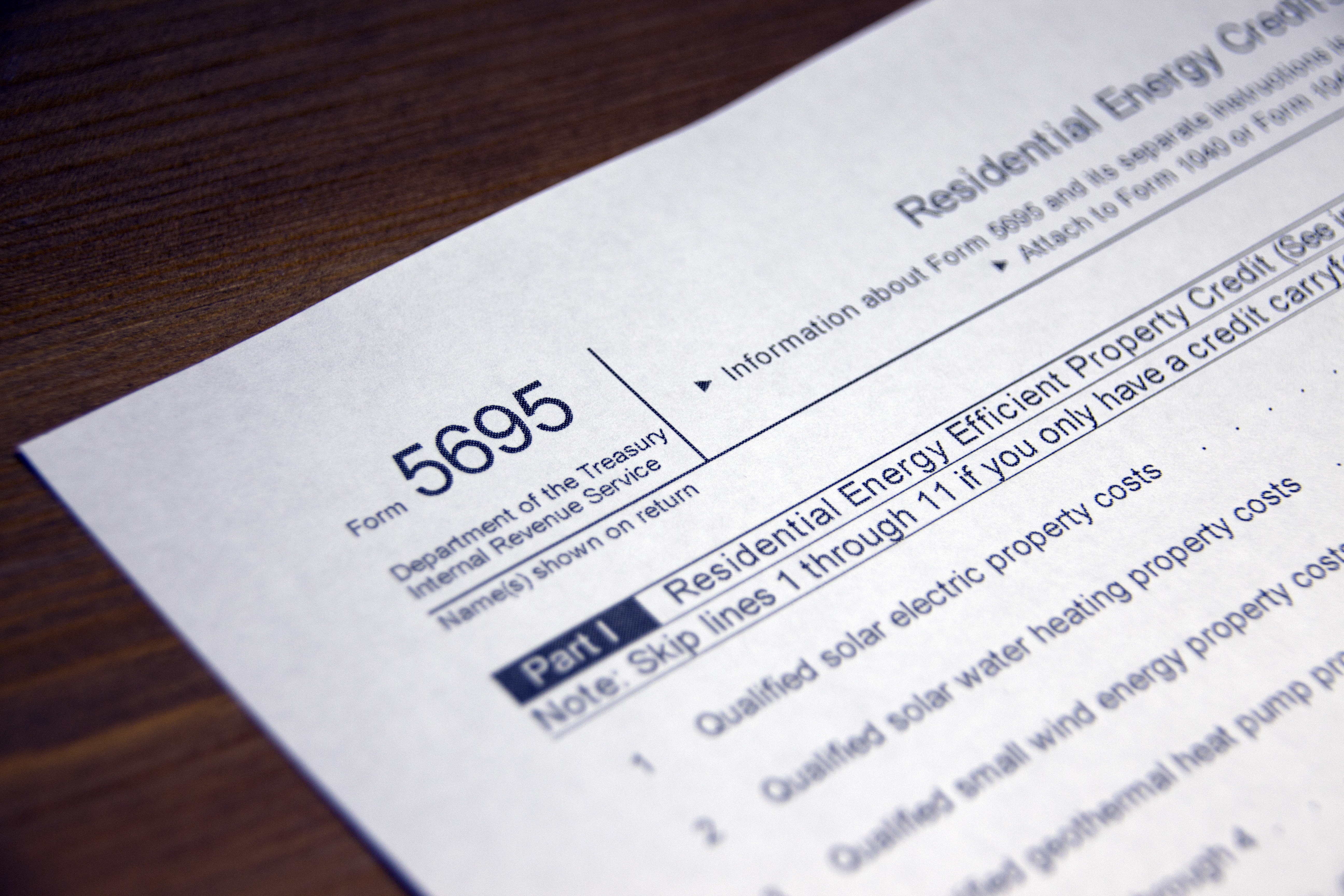

Credit Limit Worksheet Fill Online Printable Fillable Blank

Credit Limit Worksheet Fill Online Printable Fillable Blank

Tax Deduction Worksheet For Pilots Flight Attendants Other

Tax Deduction Worksheet For Pilots Flight Attendants Other

Tax Manual Toc And Appendix Combined

Chapter 3 Business Financial And Administrative Management

Chapter 3 Business Financial And Administrative Management

27 Elegant Truck Driver Expenses Worksheet Incharlottesville Com

How To Read A W 2 Earnings Summary Credit Karma

How To Read A W 2 Earnings Summary Credit Karma

25 Inspirational Deductions And Adjustments Worksheet Images

25 Inspirational Deductions And Adjustments Worksheet Images

Tax Deduction Worksheet For Pilots Flight Attendants Other

Tax Deduction Worksheet For Pilots Flight Attendants Other

16 Real Estate Tax Deductions For 2019 2019 Checklist Hurdlr

16 Real Estate Tax Deductions For 2019 2019 Checklist Hurdlr

The State Of State And Local Tax Policy Key Elements Of The U S

Belum ada Komentar untuk "Airline Pilot Tax Deduction Worksheet"

Posting Komentar