Colorado Pension And Annuity Exclusion Worksheet

If you receive pension or annuity income from the colorado public employees retirement association pera or denver public school retirement system dpsrs and worked for an employer covered by these plans for any period between 1984 and 1986 you may be able to claim a subtraction specifically for this income. Well as a colorado resident you could have some tax benefits on this income.

Taxslayer Guide For Colorado Table Of Contents Tax Year 2016

Clear and reset calculator.

Colorado pension and annuity exclusion worksheet. How to figure the tax free part of nonperiodic payments from qualified and nonqualified plans and how to use the optional methods to figure the tax on lump sum distributions from pension. Colorado pension annuity exclusion. For taxpayers who are at least 65 years of age colorado allows a 24000 pensionannuity subtraction.

How do i qualify for this pension and annuity subtraction. For your particular situation searching the database for the following might have helped you. Pension exclusion computation worksheet taxhow enter your net taxable pension and retirement annuity included in your federal adjusted gross income.

Lets dig into some of the details. 3 total employee contributions. Fyis provide general information concerning a variety of colorado tax topics in simple and straightforward.

Under colorado tax code you may be able avoid including some or all of this income as taxable income on your colorado tax return. Colorado pension and annuity exclusion worksheet incorrectly allows premature distribution to be excluded thank you for using proseries. Taxpayers who are at least 55 years of age as of the last day of the tax year.

The retirees age on december 31 is used to determine the exclusion amount for that year. General information colorado allows a pensionannuity subtraction for. 7 total gross paid 0.

Enter taxable amount directly or use the worksheet. How to figure the tax free part of periodic payments under a pension or annuity plan including using a simple worksheet for payments under a qualified plan. Colorado law excludes from colorado state income tax total pension income up to 20000 per year per person for those retirees age 55 through 64 or 24000 for those retirees age 65 and over.

No pension exclusion but exclude 0 public safety officer insurance 2. Also colorado still allows a 20000 pensionannuity exclusion for taxpayers who are at least 55 but not yet 65 years of age as of the last day of the tax year. As pension income.

Please see the fyi for more information on the pension subtraction. Beneficiaries of any age such as a widowed spouse or orphan child who are receiving a pension or annuity because of the death of the person who earned the. Pension subtraction for married couples when both spouses receive social security this fyi has been combined with fyi income 25.

Taxpayers name and pension type. Do not include any amount sub sion enter only the social security andor railroad retirement benefits of the spouse receiving the pension on the worksheet.

How To Maximize Social Security Benefits On Your Tax Return Fox31

How To Maximize Social Security Benefits On Your Tax Return Fox31

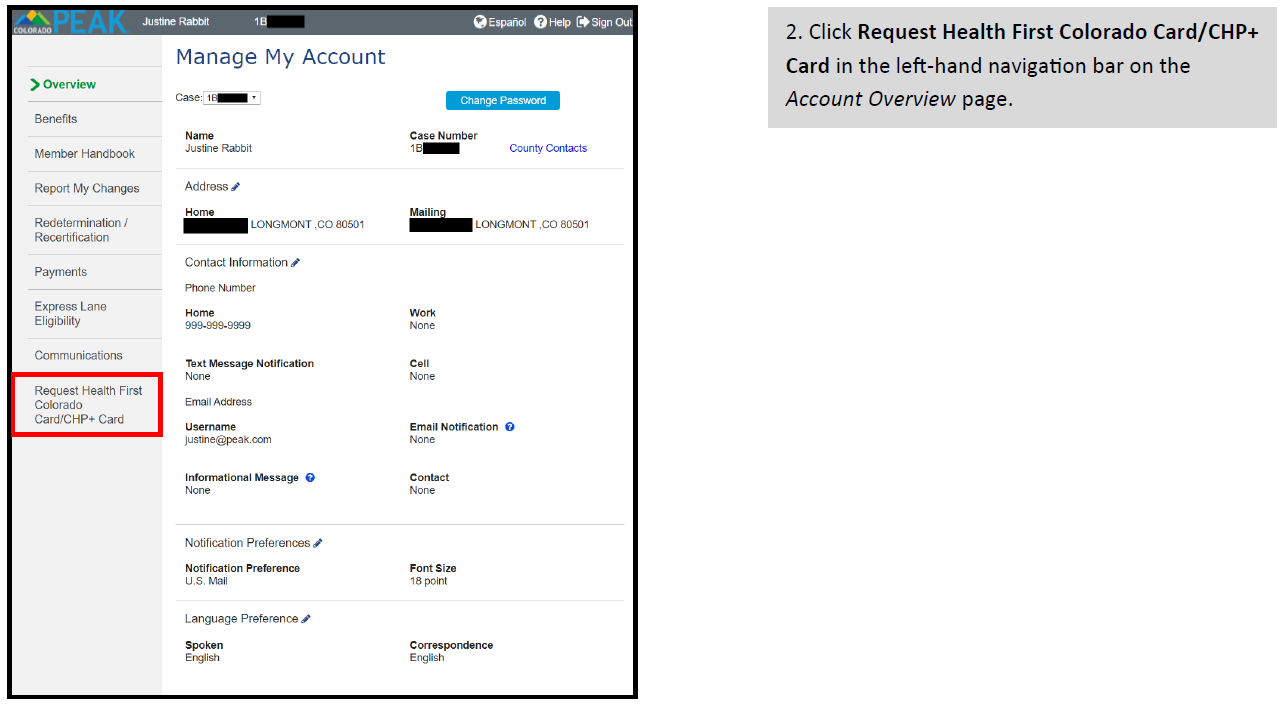

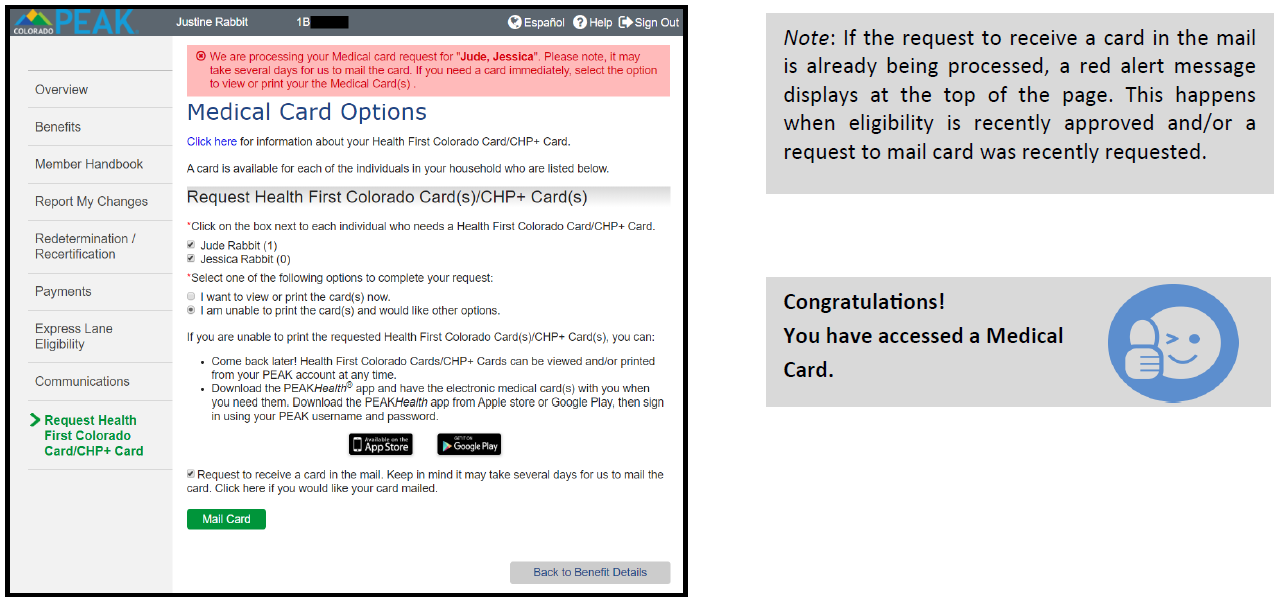

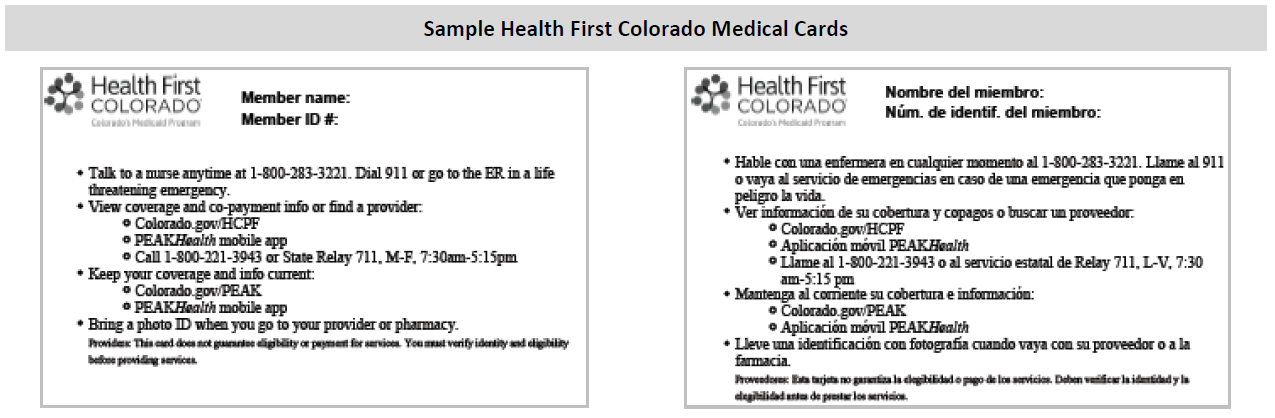

All Frequently Asked Questions Colorado Gov Health

All Frequently Asked Questions Colorado Gov Health

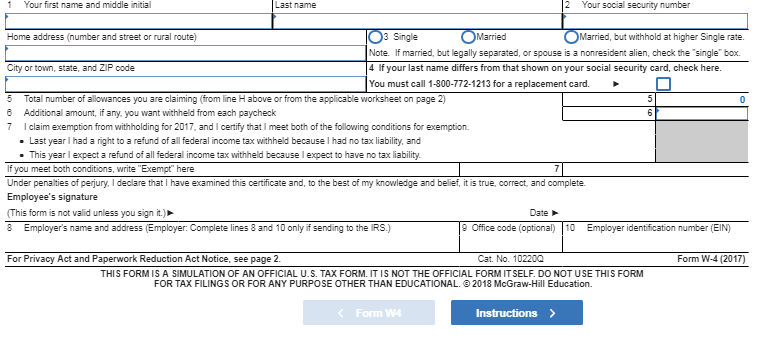

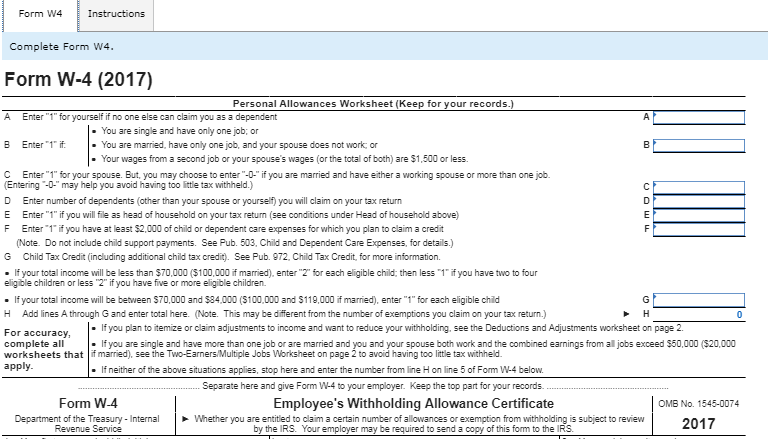

Complete The W 4 For Employment At Superore Wheels Chegg Com

Complete The W 4 For Employment At Superore Wheels Chegg Com

Worksheet For Recipients Of Pera Dps Pension Benefits Printable Pdf

Worksheet For Recipients Of Pera Dps Pension Benefits Printable Pdf

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041

Colorado Gov Cms Forms Dor Tax Cy104

Colorado Gov Cms Forms Dor Tax Cy104

Taxslayer Guide For Colorado Table Of Contents Tax Year 2016

Public Pensions Watch 2016 Archive Actuarial Outpost

Colorado Gov Cms Forms Dor Tax Cy104

Colorado Gov Cms Forms Dor Tax Cy104

Complete The W 4 For Employment At Superore Wheels Chegg Com

Complete The W 4 For Employment At Superore Wheels Chegg Com

Colorado Child Support Commission

D Epartm Ent Of The Treasury Internal Revenue Service 2 0 1 8 F

City Of Greeley Sales Tax On Food Rebate Program 2018

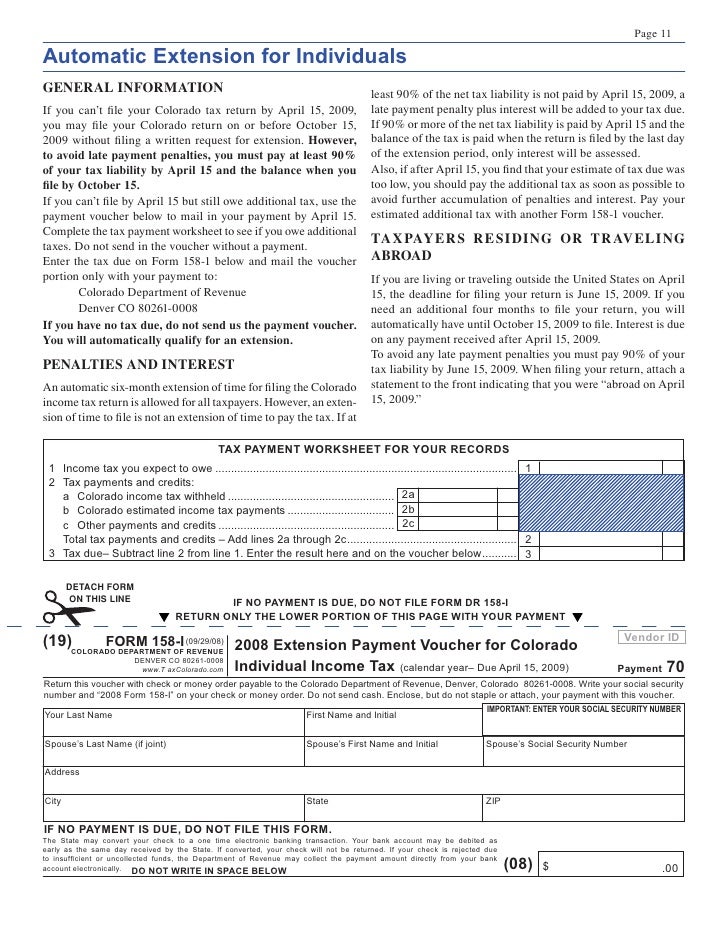

Colorado Gov Cms Forms Dor Tax Cy104inst

Colorado Gov Cms Forms Dor Tax Cy104inst

Taxslayer Guide For Colorado Table Of Contents Tax Year 2018

Colorado Fiduciary Income Tax Filing Guide

Colorado Income Tax Filing Guide Pdf

Colorado Income Tax Filing Guide Pdf

Taxslayer Guide For Colorado Table Of Contents Tax Year 2018

Taxslayer Guide For Colorado Table Of Contents Tax Year 2018

All Frequently Asked Questions Colorado Gov Health

All Frequently Asked Questions Colorado Gov Health

All Frequently Asked Questions Colorado Gov Health

All Frequently Asked Questions Colorado Gov Health

Welcome To Adams 12 Five Star Schools Human Resources

/GettyImages-144560286-577404875f9b5858752b6d6d.jpg) 13 States That Tax Social Security

13 States That Tax Social Security

Colorado Department Of Revenue Taxpayer Service Division

Welcome To Adams 12 Five Star Schools Human Resources

Belum ada Komentar untuk "Colorado Pension And Annuity Exclusion Worksheet"

Posting Komentar