Shareholder Basis Worksheet Excel

An s corp basis worksheet is used to compute a shareholders basis in an s corporation. S corporation shareholder stock basis worksheet.

Publication 5292 2017 How To Calculate Section 965 Amounts And

Publication 5292 2017 How To Calculate Section 965 Amounts And

There are separate worksheets for stock and debt basis.

Shareholder basis worksheet excel. The initial stock basis is the amount of equity capital supplied by the shareholder. Decreased for items of loss and deduction. Increased for income items and excess depletion.

To move to the basis wks screen for another person or entity open that persons or entitys k1 screen and click the basis worksheet tabs there. See open account debt page 19 11 thetaxbook deluxe editionsmall business edition. The top of the basis worksheet and basis worksheet continued screen displays the id number and name of the person or entity to which the worksheet refers.

A shareholder has a stock basis and a debt basis. You do need to prepare a worksheet like the one linked above for each prior year of your ownership in order to get to your current basis. When determining the taxability of a non dividend distribution the shareholder looks solely to his stock basis.

The amount that the propertys owner has invested into the property is considered the basis. This basis fluctuates with changes in the company. Each block of stock is accounted for separately.

Tax preparers should maintain the following two worksheets courtesy small business taxes and management for each of their s corporation shareholder clients. This amount entered on line 20 is the shareholders stock basis for calculating gain or loss on the stock disposition. I hope this helps for computing your basis in the s corporation.

Losses from s corporations are deductible on a taxpayers form 1040 only to the extent of the shareholders stock plus debt basis. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. The initial debt basis is the amount of money loaned by the shareholder to the s corporation.

For losses and deductions which exceed a shareholders stock basis the shareholder is allowed to deduct the excess up to the shareholders basis in loans personally made to the s corporation see item 4 below. This worksheet assumes loans from the shareholder are combined and not evidenced by separate written instruments. If a portion of the shareholders stock is disposed of enter the stock basis related to the shares sold after considering the current years adjustments eg income expense and distribution items.

Stock basis is adjusted annually as of the last day of the s corporation year in the following order. Decreased for non deductible non capital expenses and depletion. Stock basis is also adjusted when shareholders buy sell or transfer shares.

Does An S Corporation S Credit Card Debt Increase Shareholders

Does An S Corporation S Credit Card Debt Increase Shareholders

The Basics Of S Corporation Stock Basis

The Basics Of S Corporation Stock Basis

Editable S Corp Shareholder Basis Worksheet Excel Fill Print

Editable S Corp Shareholder Basis Worksheet Excel Fill Print

S Corporation Basis Distributions

S Corporation Basis Distributions

2016 Business Tax Renewal Instructions Los Angeles Office Of Finance

Pdf How To Prepare A Business Plan With Excel

Pdf How To Prepare A Business Plan With Excel

Managing S Corporation At Risk Loss Limitations

Managing S Corporation At Risk Loss Limitations

Construction Cost Sheet For General Contractor Itemized Fee

![]() Line Of Credit Tracker For Excel

Line Of Credit Tracker For Excel

Balance Sheet Template Simple Basic Accounting Example Worksheet

Retail Investor Org How To Keep Track Of Your Stock Portfolio

18 Printable Shareholders Agreement Sample In Word Format Templates

18 Printable Shareholders Agreement Sample In Word Format Templates

Shareholder Basis Worksheet Karenlynndixon Info

Basis Reporting Required For 2018 Draft Form Schedule E

Shareholder Basis Worksheet Karenlynndixon Info

How To Calculate Stock And Loan Basis In An S Corp For Tax Purposes

How To Calculate Stock And Loan Basis In An S Corp For Tax Purposes

Proconnect Tax Online Archives Tax Technologist Blog

Proconnect Tax Online Archives Tax Technologist Blog

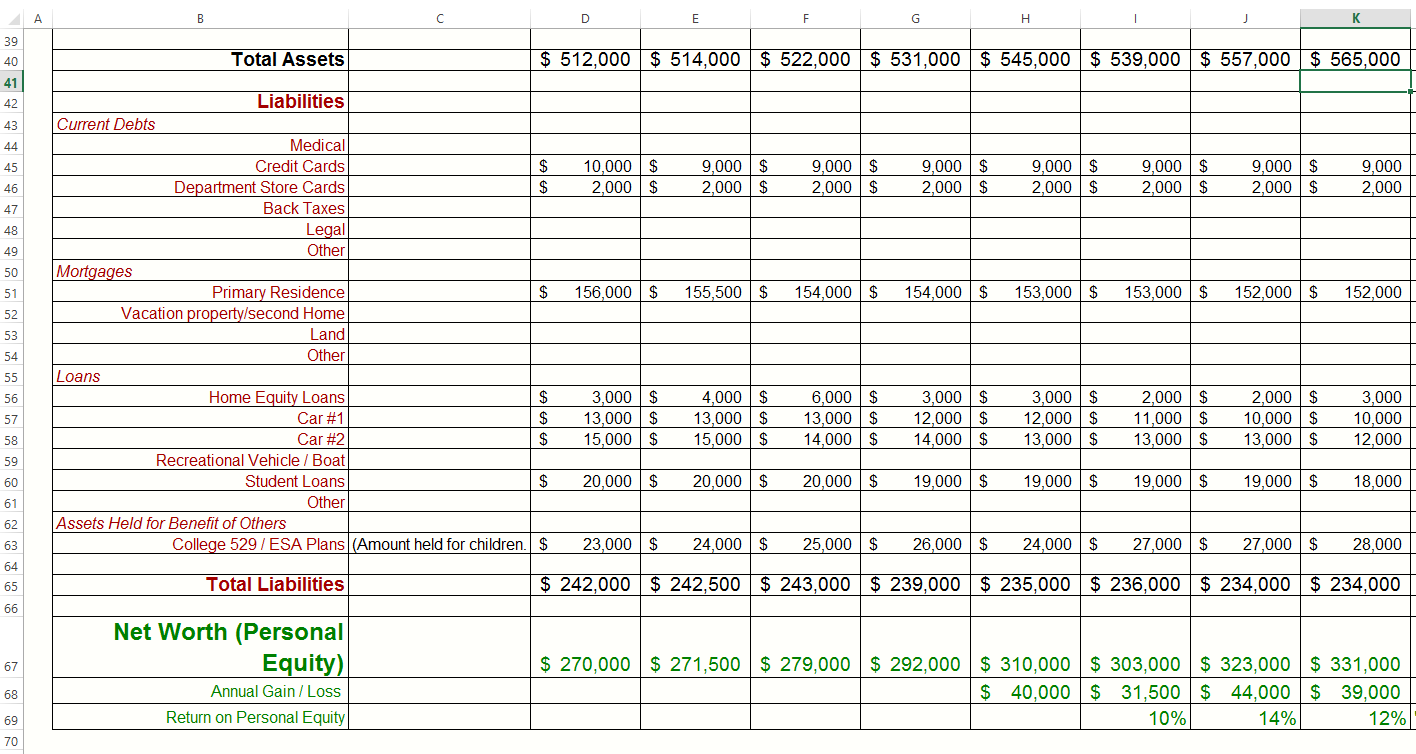

Net Worth Calculation Spreadsheet

Net Worth Calculation Spreadsheet

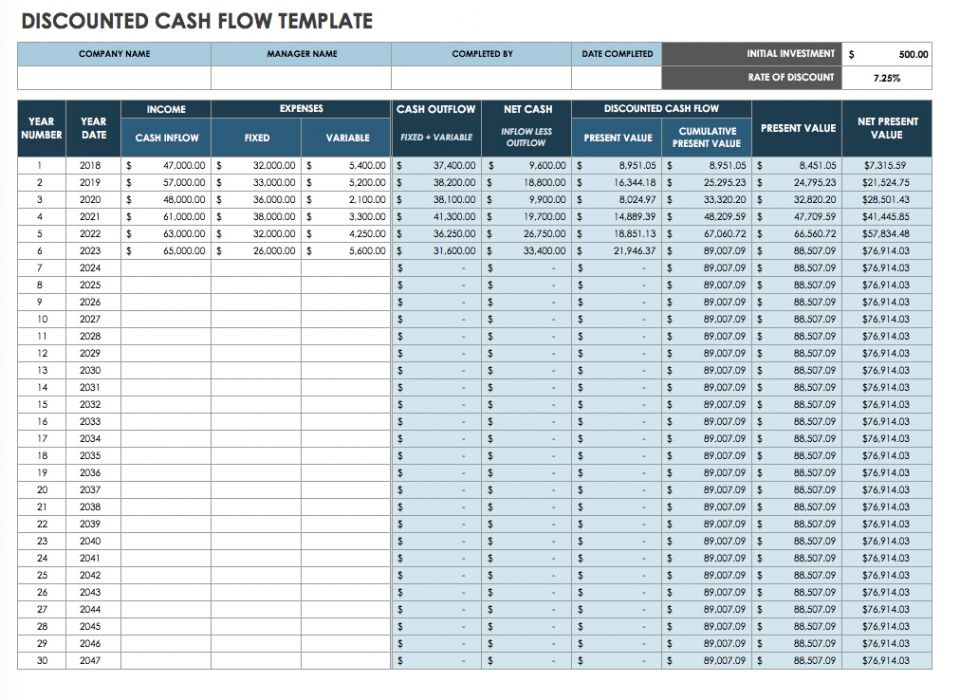

Free Cash Flow Statement Templates Smartsheet

Free Cash Flow Statement Templates Smartsheet

Spreadsheet Risks Still Being Ignored By C Suite Study Cfo

Spreadsheet Risks Still Being Ignored By C Suite Study Cfo

16 7 More On S Shareholder Basis Youtube

16 7 More On S Shareholder Basis Youtube

Best Basic Excel Formulas Top 10 Excel Formulas For Any Professionals

Best Basic Excel Formulas Top 10 Excel Formulas For Any Professionals

Shareholder Basis Worksheet Karenlynndixon Info

S Corporation Basis Distributions

Guide To Calculating Cost Basis Novel Investor

Guide To Calculating Cost Basis Novel Investor

You have good articles here! If anyone here is looking for a loan @ 2% rate in return to buy a home or other financing needs, I want you to contact Mr Pedro On pedroloanss@gmail.com When I was introduced to Mr. Pedro at the market watch seminar, I was entering the market as a first time buyer. Naturally,my needs were a bit different and I had loads of questions. Before he sent me my pre-approval letter, he called to speak with me about what it meant and what could change. He made himself available to me at pretty much any hour via email and texts. He was very responsive and knowledgeable. He’s also very straightforward. I explained to him what my expectations were in terms of closing time and other particulars. He said he would meet those expectations but he surpassed them. I closed so quickly my realtor and the seller of course were excited about that. But as a buyer I appreciated being walked through the process of Mr Pedro loan offer. From pre-approval to closing- the journey was so seamless and I consider myself lucky because I’ve heard horror stories. I recommend him to anyone looking for a loan. Everything was handled electronically expediently and securely

BalasHapus